Trustee for Mother’s Estate Sells TOLI Policy

April 19, 2018

Financial advisors often rely on our life settlement success stories as a learning tool for recommending solutions to clients with unwanted life insurance policies. In reviewing some of our recent transactions, I’ve chosen to highlight a recent case involving a trust-owned life insurance (TOLI) policy.

This case is particularly instructive for advisors who are seeking to expand their knowledge regarding the application of life settlements in connection with their high net worth clients’ estate plans. Many advisors are discovering that a life settlement for a TOLI policy that is no longer relevant for estate tax planning is a far better solution than the alternatives such as lapse or surrender.

In addition to demonstrating how a life settlement is an effective tool when it comes to the disposition of obsolete insurance policies, this case also illustrates how a trustee, the son of the grantor, actually fulfilled his own fiduciary duty as it relates to the disposition of a TOLI policy.

Finally, this case explains how an advisor with no previous experience in handling life settlement transactions can spearhead the transaction for his client by partnering with the team at Asset Life Settlements.

Advisor’s first life settlement

The case was referred to us by an advisor from one of Asset Life Settlements’ national accounts. The advisor had never participated in a life settlement transaction in the past, so I was happy to take the lead and guide him and his client through each step of the life settlement process.

The advisor’s client, an astute businessman who served as the trustee for his mother’s estate, had sought the advisor’s guidance when the annual premiums became too expensive. The client explained that the policy had been purchased in 2003 when the federal estate tax exemption was $1 million per individual. Given the recent increase in the federal estate tax exemption to $11 million per individual, it became clear to the client that the policy was no longer needed to achieve the objectives of the trust. The fact that annual premium payments were depleting the cash assets in the trust raised alarm bells, and the trustee realized it was his fiduciary duty to take action now.

The advisor immediately facilitated a policy review and contacted me to discuss various options.

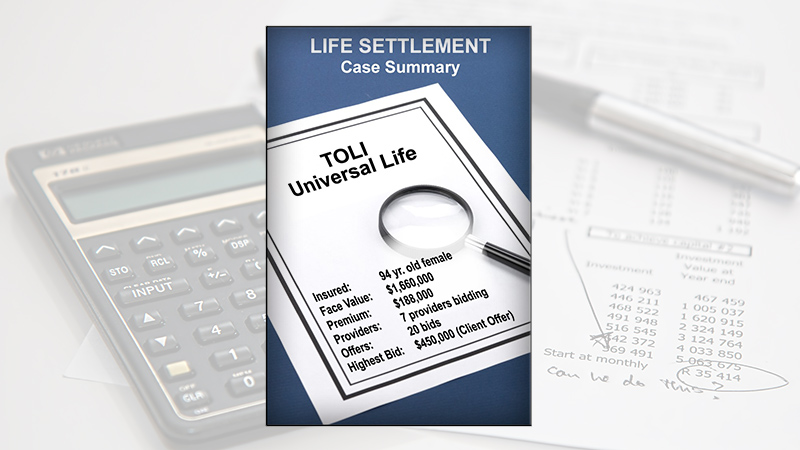

Once it was determined that a life settlement was clearly the best solution, I submitted the case to approximately 12 providers licensed in the seller’s state. Over half of the licensed providers presented life settlement offers for the purchase of the policy. During the course of the bidding process involving the seven providers, a total of 20 bids were submitted.

Once the bidding stage appeared to be complete, I informed the advisor that the highest net offer to his client would be $410,000. The trustee was more than pleased with that amount and instructed his financial advisor and me to proceed with a formal acceptance of the offer and then go to contract.

Due to the strong interest in the policy by providers, the frequent daily bidding activity, and my past experience with similar cases, I decided to keep the case open while I proceeded to collect the required ownership and trust information necessary to go to contract.

I indicated to the advisor and his client that if I was successful in negotiating a higher life settlement amount than the one he had already accepted, that the entire amount would go to the policy seller with no additional commissions taken.

As it turns out, bidding activity picked up again and additional offers continued to drive the purchasing price above the $410,000 that the client had already accepted. When the bidding finally came to a close, the highest offer to the client was $450,000. The advisor and the trustee were stunned with the news that they would be getting an additional $40,000 for the policy and were extremely grateful that I had the foresight not to shut down the bidding too soon.

Take-away for advisors

As many advisors are aware, trust-owned life insurance is often considered central to many high net worth clients’ estate plans. The cash proceeds from a trust-owned life insurance policy can provide liquidity for a variety of purposes, including the payment of estate taxes after the grantor has passed away, for contributions to charitable organizations, or to balance inheritances among the estate’s heirs. However, there often comes a time when the original purpose for the policy no longer exists.

The tricky part involving TOLI policies is the fact that many trustees (whether they are family members serving as trustees or professional trustees), often view life insurance as a long-term asset that is not intended to mature for many years. Consequently, some trustees may overlook the fact that it is an asset that must be actively managed and monitored.

Irrespective of training or background, a trustee has a fiduciary duty to administer the trust’s assets in a prudent and impartial manner for the benefit of the trust’s beneficiaries. When it comes to trust-owned life insurance, this means that it is the trustee’s duty to exercise the standard of care required to regularly monitor the performance of the policy. Part of that duty involves determining whether the policy is still relevant in terms of its estate planning objectives.

Insurance-licensed advisors who are reading this case summary will immediately recognize this scenario as an opportunity to offer their expertise to trustees in terms of conducting annual reviews for TOLI policies. Examples of red flags that the trustee and/or the insurance advisor will want to monitor include:

- Policy’s ROI is not performing as illustrated due to the low interest rate environment.

- Premiums have escalated and cash assets in the trust are being drained to make the payments.

- The policy is no longer needed due to increases in the federal estate tax exemption.

If you are a financial advisor who is committed to increasing your understanding of how life settlements can be an effective estate planning solution, feel free to call me at 888-335-4769 x1108. I will be happy to discuss any potential cases on your desk as well as provide an immediate pricing analysis to share with your client(s).